Is it even worth dealing with Mint’s sync errors in 2026? Let’s be real: we’ve all been there.

I’m part of the Sofi ai team, but before that, I was a die-hard Mint user for years. I know what it’s like to open the app only to find your accounts haven't updated in three days or that your spending chart looks like a jigsaw puzzle with missing pieces. In this post, I’m not here to sell you a dream. I’m going to tell you, peer-to-peer, why we decided to build Sofi ai in a radically different way.

| Feature | Sofi ai | Mint (Intuit) |

|---|---|---|

| Sign-up Method | AI + Email (Zero Friction) | Bank Sync (OAuth) |

| Security | CASA Level 3 (Top Tier) | Industry Standard |

| Privacy | Your data is yours | Lead selling and ads |

| Categorization | Precise Multilingual AI | Rigid rules (Frequent fails) |

What surprised me (and what frustrates me)

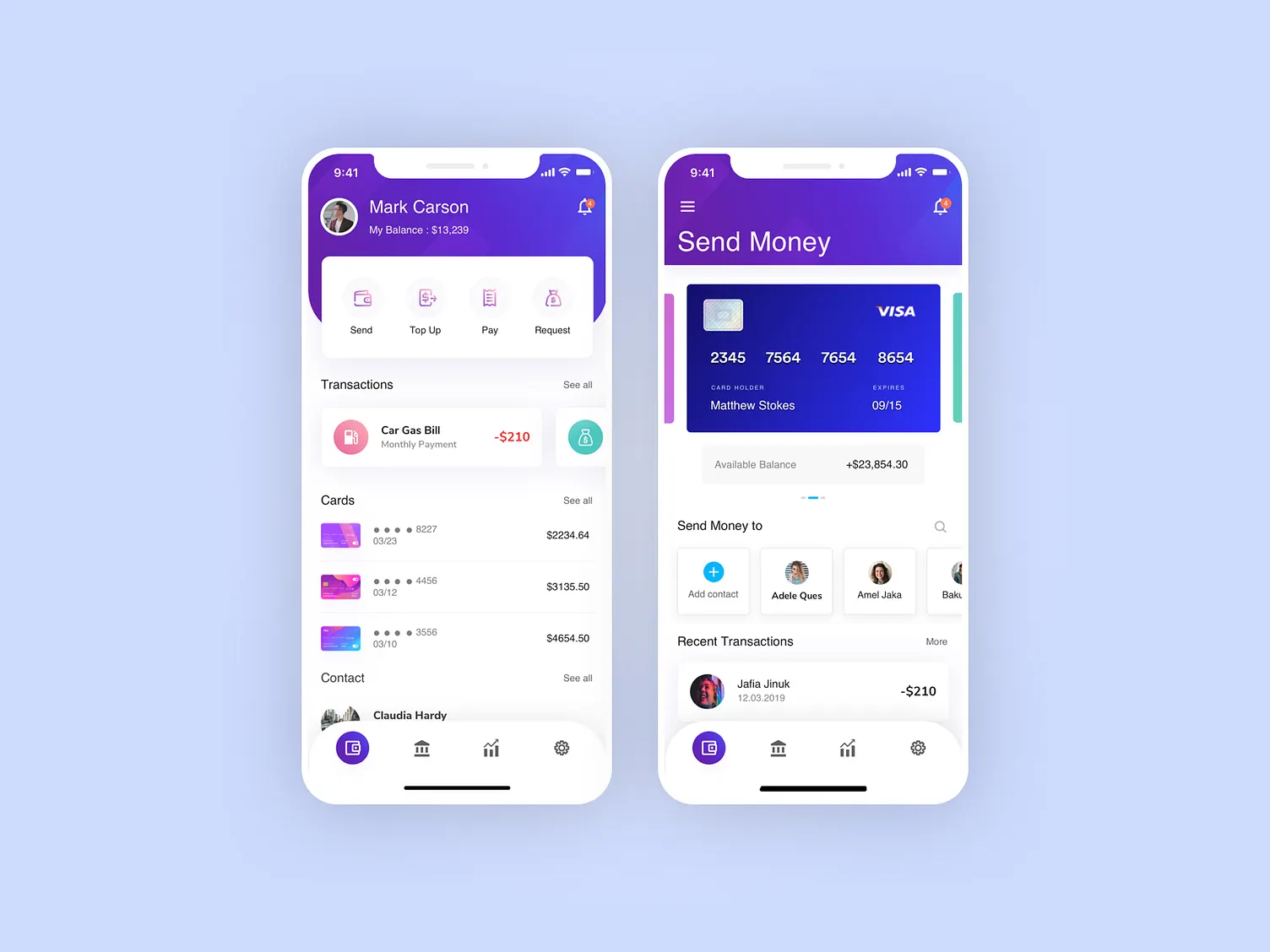

When we tested Mint again for this review, the nostalgia was real, but the reality was a total reality check. Mint’s interface feels stuck in the past. Sure, it has colorful charts, but what really grinds my gears is that it depends on you handing over the keys to your house (your bank passwords), and even then, the connections drop constantly.

"Our team tried connecting three different banks to Mint: two of them failed by day two due to 'technical issues.' It’s a pain to set up and even harder to keep running."

Mint has been the giant for decades, but their business model is built on selling you financial products. That’s why every time you log in, you’re bombarded with credit card offers and loans you never asked for. In 2026, that just feels invasive. Technology has come far enough that an app should work for you, not for the banks that want you in debt.

Looking deep into Mint, we noticed their architecture hasn't substantially changed to meet modern privacy needs. They still use data aggregators that, while the "standard," represent a latent risk. Every time Mint tries to update your balances, it makes a request that can be flagged by your bank's security, forcing you to re-authenticate over and over. It’s a cycle of frustration that shouldn’t exist in the age of AI.

In contrast, with Sofi ai, we took a philosophical stand that people ask me about all the time: "Why don't we just connect the bank directly?". The answer is simple: your security is worth more than saving 10 seconds of data entry. We don't want your passwords. We use AI to read your receipts and email notifications. It’s amazing. You get the same analytical detail without the risk of a database breach giving someone access to your actual money.

The Security Factor: My Personal Shield

This is where I get serious. If you’re looking for a Mint alternative, security is non-negotiable. Sofi ai holds a CASA Level 3 (Certified Application Security Auditor) certification. This isn't just a badge we bought; it’s a deep-dive audit of our infrastructure. While other apps remain vulnerable, we lock down your data with end-to-end encryption.

Most personal finance apps stop at basic compliance. We went further because we understand that in 2026, cyberattacks are way more sophisticated. CASA Level 3 means outside experts tried to break into our system and failed. It’s the same level of scrutiny required for top-tier banking apps.

Think about it: every time you give your bank password to a third-party app, you're creating a point of failure. Even with encryption, the fact that your credentials live on another server is a risk we decided not to take at Sofi ai. Our email extraction tech allows data to flow safely, pulling amounts, merchants, and dates with a precision that beats Mint’s basic categorization, which often confuses a utility bill with a luxury purchase.

Deep Dive: AI vs. Rigid Rules

One of the areas where the generational gap is most obvious is expense categorization. Mint uses a rule-based tag system. If you buy something on Amazon, Mint marks it as "Shopping," but it doesn't know if you bought diapers or a video game. You almost always have to go in and fix it manually.

At Sofi ai, the AI analyzes the context of the receipt. Since we process the full invoice that hits your inbox, we know exactly what’s inside the box. If you bought meds and groceries at the same store, our AI can split them up with accuracy that’s almost scary (in a good way). Plus, since it’s multilingual, it doesn’t matter if your receipt is in Spanish, English, or any other language; the AI interprets it and puts it in the right budget category without you lifting a finger.

This "intelligent itemization" is crucial for a real budget. In Mint, if you spend $200 at a superstore that also sells electronics, those $200 go straight to "Groceries." With Sofi ai, the AI spots that you bought a coffee maker and separates that expense automatically. That’s the difference between having raw data and having actionable info that lets you make smart financial moves.

And we don't stop at tracking. Sofi ai gives you proactive savings suggestions. If we notice your phone plan is pricier than the average user with your profile, the AI lets you know. Mint will tell you that you spent too much, but Sofi ai tells you how to spend less tomorrow.

Sofi ai: The Verdict

- ✓ Total Privacy: We never touch your bank accounts or ask for your passwords.

- ✓ Advanced AI: Categorizes with precision by analyzing full receipts, not just surface-level transactions.

- ✓ Incentives: Our weekly $50 giveaway is real and direct. It’s our way of rewarding your financial discipline.

- × Design Stance: Requires you to let the AI process your receipts automatically.

Mint: My Take

- ✓ Credit History: It’s still handy to have that metric integrated for a quick glance.

- ✓ Zero Direct Cost: You don’t pay a monthly subscription for basic features.

- × Ad Overload: The interface is cluttered with financial offers you don't necessarily need.

- × Sync Glitches: Bank connections are unstable and require constant manual upkeep.

The Business Model: Transparency vs. Advertising

Something I learned while working on the Sofi ai product is that "if you're not paying for the product, you are the product." Mint is free because Intuit (the owner) uses your spending habits to show you targeted ads. If you spend a lot at pet stores, you’ll be flooded with dog insurance offers. It’s not illegal, but in 2026, we’re looking for a cleaner relationship with our digital tools.

At Sofi ai, we have an extremely generous Free Plan, but our model isn't about selling you out. It’s about giving you AI tools that actually improve your life. Our premium version offers even deeper insights, but we never sacrifice a clean UI for an ad banner. We want you in the app to see your progress, not to be tempted into more debt you don't need.

Data ethics is a core pillar of our culture. Unlike traditional platforms that aggregate your data to sell market trend reports to third parties, Sofi ai implements aggressive anonymization protocols. Even on our free plan, your financial identity is protected by layers of security that exceed standard legal requirements.

Plus, multi-device sync on Sofi is flawless. You can check your budgets on your tablet, phone, or computer, and everything will be there, encrypted and backed up in the cloud. Mint has tried to modernize, but its technical foundation is still bloated, leading to a sluggish and sometimes frustrating experience on modern mobile devices.

Why the Change is Inevitable

The financial world is shifting toward decentralization and individual control. Sticking with tools that require full access to your bank passwords is like using 2010 tech in a 2026 world. AI isn't just a buzzword; it’s the engine that makes Sofi ai faster, safer, and much more accurate than any rigid system from the past.

At the end of the day, the best tool is the one that doesn't give you extra work. If you’re spending more time fixing Mint’s categories or reconnecting your banks than you are analyzing your savings, the tool is failing you. Sofi ai removes that operational friction, letting you focus on what really matters: hitting your financial goals, whether that’s buying a house, traveling, or just building a rock-solid emergency fund.

Conclusion: Which one should you choose?

If you aren't bothered by a massive corporation knowing every move your accounts make and hitting you with ads, Mint is functional. It’s a classic tool for someone who just wants to see aggregated numbers every now and then and doesn't mind the manual upkeep.

But if you’re looking for a tool in 2026 that acts like a smart assistant, protects your privacy with the highest standards (CASA Level 3), and actually learns from your habits to help you improve, Sofi ai is the winner. The peace of mind that comes from knowing your bank passwords aren't sitting on an external server is priceless.