Let’s be real: Who has the time in 2026 to fight with an app every time they buy a coffee? If you are coming from YNAB (You Need A Budget), you know exactly what I am talking about.

Here at the Sofi ai team, we have tried it all. I was personally a YNAB "evangelist" for years. I loved that feeling of total control, that high of "giving every dollar a job." But, being honest with you, it eventually turned into a second job. I found myself frustrated every Sunday, staring at 20 uncategorized transactions because the bank sync failed or because I forgot to log a cash expense.

In 2026, technology should be working for us, not the other way around. That is why we built Sofi ai. We wanted the rigor of a solid budget but with the agility of Artificial Intelligence. Here is my honest review after months of pitting these two philosophies against each other.

| Feature | Sofi ai (The Future) | YNAB (The Old Way) |

|---|---|---|

| Learning Curve | Instant (AI handles the setup) | Very steep (Requires "studying") |

| Data Security | CASA Level 3 (No bank passwords) | Third-party (Plaid/Bank credentials) |

| Expense Tracking | Auto via Email / Receipts | Manual or unstable Bank Sync |

| Price | Powerful Free Plan | Mandatory annual subscription |

What blew my mind (and what wears me out)

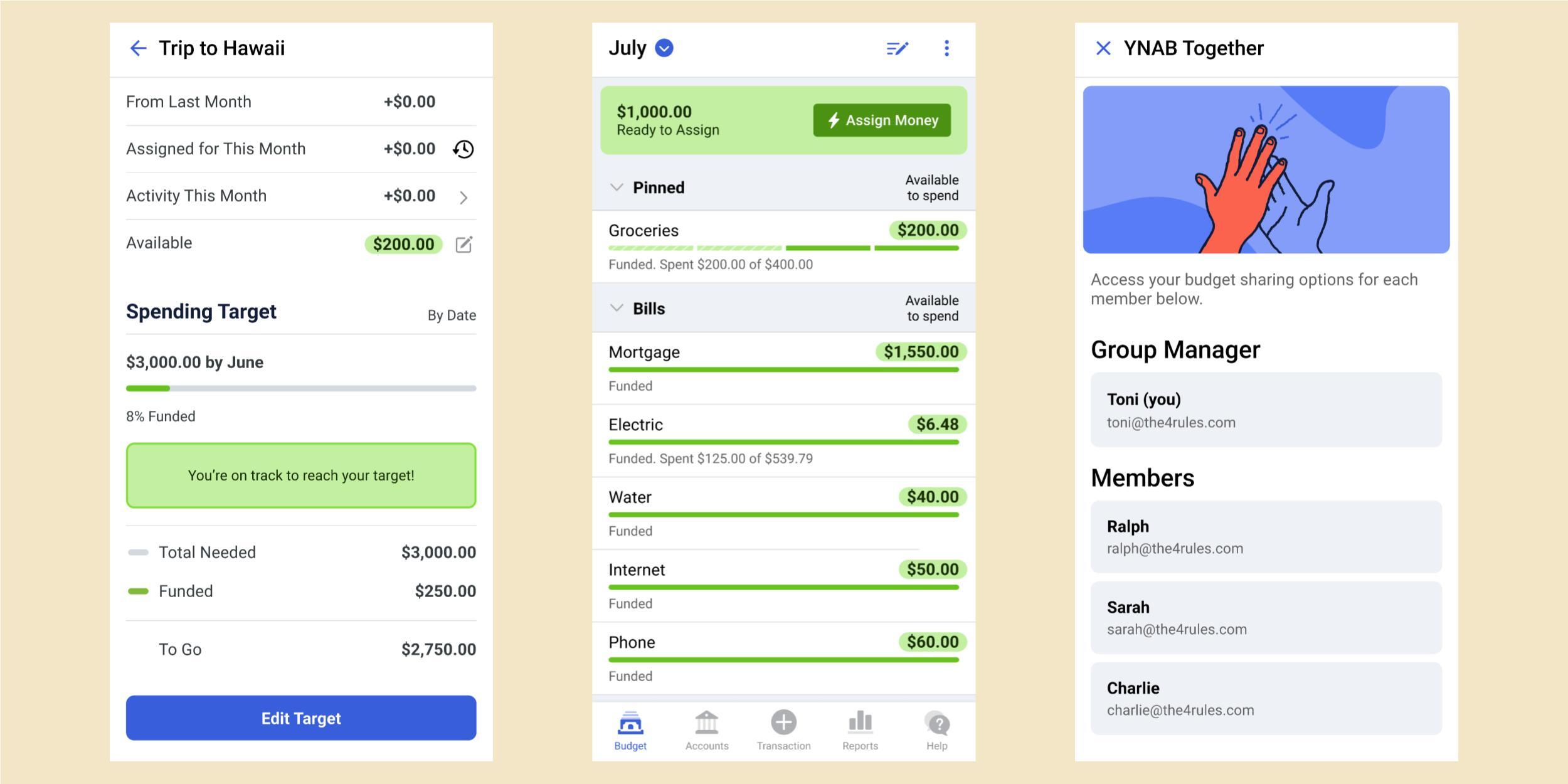

If there is one thing to admit about YNAB, it is that the methodology works... if you are an extremely disciplined person. But in my testing, what really grinds my gears is the interface. It feels like a glorified spreadsheet from the 90s. It is dense, packed with red numbers shouting "Error!" and requires you to be an expert accountant just to understand why your "Available" balance doesn’t match your actual bank account.

"We tried importing a month’s worth of expenses for an average user into YNAB: it took us 45 minutes to reconcile everything manually. In Sofi ai, the AI processed the same data from email receipts in less than 2 minutes. The gap is massive."

Searching for a YNAB alternative, many users complain that the app has become "clunky." In 2026, we want speed. At the Sofi team, we thought: Why force the user to classify every single thing if the AI can read the Amazon receipt and know exactly what was bought?

In YNAB, if you buy something at a supermarket, the app flags it as "Groceries." But if you actually bought a gift card or clothes there, your budget gets messy. Sofi ai analyzes item by item. Thanks to the connection with your email, our AI breaks down the actual invoice. That is not just saving time; it is having real data to make decisions, not just vague averages.

Security: Why we DON'T connect your bank

A lot of people ask me why we don’t use Plaid or Salt Edge to directly connect the bank like YNAB does. The answer is a design and security stance: Your bank is sacred. Our team does not recommend giving account access to third parties, period.

YNAB relies on you handing over your credentials so they (or their providers) can log in to "look" at your movements. At Sofi ai, we are paranoid (in a good way). We hold the CASA Level 3 (Certified Application Security Auditor) certification. It is the highest security standard for applications. By using email and receipt extraction, we get the same analytical precision without your bank passwords ever leaving your head.

It is my personal peace-of-mind shield. If a bank data aggregator gets hacked, YNAB users have a serious problem. Sofi ai users are shielded because we don’t store "keys"; we only read the information you choose to send us through your invoices and notifications.

Sofi ai

- ✓ Real Automation: The AI categorizes for you while you sleep.

- ✓ Privacy Pro: CASA Level 3 certification. Zero bank risk.

- ✓ Rewards: Win $50 weekly just for being diligent. Does YNAB give you money? No, it charges you.

YNAB

- ✓ Solid Methodology: The 4-pillar system is genuinely educational.

- × Slave to Logging: Requires too much manual maintenance.

- × Old UI: Feels like working in Excel on a Monday morning.

AI: Your Personal CFO vs. A Calculator

What frustrates me about YNAB is that it is reactive. It tells you what happened, but it doesn't help you prevent it from happening again. In contrast, Sofi's AI is proactive. If the AI detects that your streaming subscriptions have gone up in price or that you are spending more than usual on delivery apps, it throws you a real savings suggestion.

Looking for a YNAB alternative in 2026, you realize we no longer want to "manage" money; we want it to manage itself. Sofi's real-time sync between mobile and desktop is seamless, without those annoying import delays YNAB suffers whenever banks update their security protocols.

"At Sofi ai, we don’t just see numbers; we see habits. Our AI understands if that pharmacy expense was an emergency or something recurring, and it adjusts your health budget automatically. That is intelligence; everything else is just bookkeeping."

The House Special: Real Motivation

Let’s be honest: budgeting is boring. That is why at Sofi ai, we decided to inject a bit of community vibe. We love rewarding people who take their financial health seriously. That is why we run a $50 weekly giveaway among our active users.

It is a small detail, sure, but it is our way of saying "hey, thanks for looking out for your future." YNAB charges you a pretty high annual subscription and in return gives you... more manual work. We prefer giving you powerful free tools and, while we are at it, the chance to earn a little extra just for using the app.

Final Verdict

If you are a manual control freak and enjoy spending 3 hours a week reconciling accounts, stick with YNAB. But if in 2026 you value your time, your bank security, and you want Artificial Intelligence to do the heavy lifting for you, Sofi ai is the way to go.

The era of suffering over your budget is over. Welcome to the future.

Last updated: February 19, 2026. Based on real-world testing conducted by the product team.